Financiers

Jean-Laurent Bonnafé: BNP Paribas

Mr. Bonnafé is the CEO of BNP Paribas, a French bank that continues to finance agribusiness linked to deforestation and human rights abuses. More than half of the Cerrado savanna in Brazil, one of the world's most precious ecosystems, has been torn apart to make way for continuously expanding soy farms — carnage funded by BNP. Recently, during a “zero-carbon” event in Paris, BNP boasted about implementing binding policies to stop deforestation caused by the soy industry; however, according to data analyzed by Global Witness, between 2013 and 2019, France’s financial sector backed five of the six most harmful agribusiness companies investigated — and which have been directly or indirectly involved in deforestation in the world’s largest tropical rainforests in the Brazilian Amazon and the Congo Basin. BNP was one of the banks coordinating a US $500 million “transition bond” for the Brazilian beef-trader Marfrig in July 2019. In simple terms, this creates a loophole for a company buying cattle that has not been raised and reared on a single property. Cattle may be sold several times, allowing those linked to deforestation to profit where deforestation checks focus only on the cattle’s latest owner.

Jamie Dimon: JP Morgan Chase

Mr. Dimon is the CEO of JP Morgan Chase, the world’s worst financer of climate chaos, having dumped over a quarter of a trillion dollars into fossil fuels in the last few years alone, continuing to fuel the flames of climate destruction. Chase’s overall financing of fossil fuels in 2016-2019 is 36% higher than the second-placed bank, Wells Fargo. On top of that, JP Morgan Chase’s $102 billion in finance for fossil fuel expansion is 43% higher than that of Citi, in distant second place. Chase has been a consistent bad actor, funding fossil fuel expansion projects that devastate the environment and violate human rights, particularly Indigenous rights.

Larry Fink: BlackRock

Mr. Fink is CEO of the investment firm BlackRock, one of the primary investors in businesses that create high environmental risks. In January 2020, BlackRock announced it would exit such investments with high environmental risks, including thermal coal. They also said that they would launch new investment products that screen for fossil fuels. Nonetheless, although Mr. Fink is well aware of the dangers of climate collapse, BlackRock continues to be a primary funder of firms that use deforestation as a source of income.

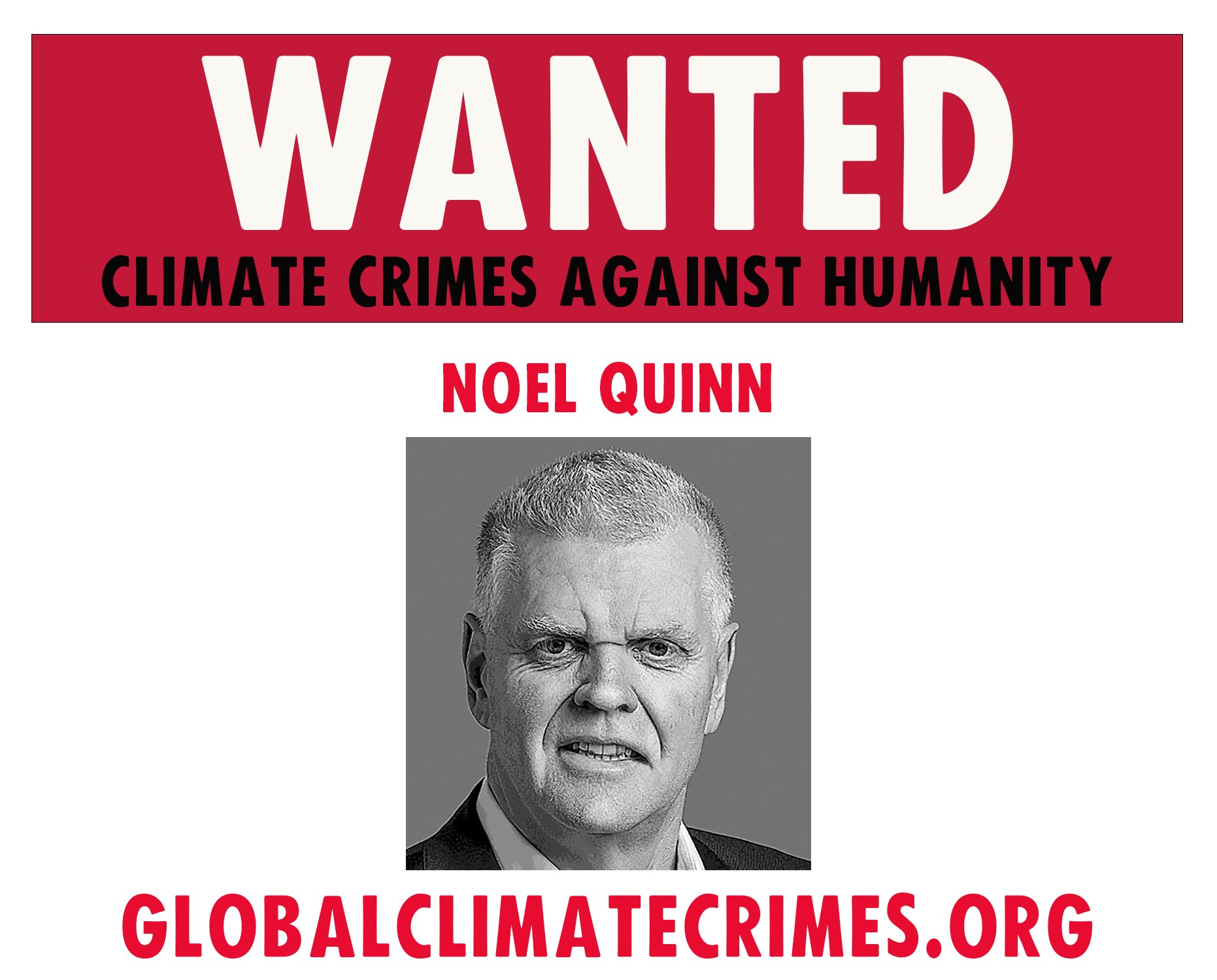

Noel Quinn: HSBC

Mr. Quinn is the CEO of HSBC, one of the world’s biggest funders of fossil fuels – the 13th-biggest in the world. Since the Paris Agreement was adopted, HSBC has funded US $111 billion in fossil fuels around the world. HSBC has long been addicted to coal, the dirtiest fossil fuel, providing billions to keep the coal-industry going. Recently, HSBC has been rocked by pressure from campaigners, and in the lead-up to its May 2021 Annual General Meeting was forced to announce phase-out dates for its financing for the coal industry. But there’s a loophole in HSBC’s pledge to phase out financing for coal by 2040 that will allow the bank to support companies with plans to build more than 70 new coal plants. The bank’s asset management arm, which is not included in the coal phase-out pledge, holds ownership stakes in companies that plan to build 73 coal power plants across 11 countries in Africa and Asia, almost enough to supply fossil fuel electricity to all the UK’s homes three times over. These new plants will emit more pollutants such as sulphur dioxide, nitrogen oxides and particulate matter than all the coal-fired power plants in the EU and the UK combined in 2019, according to a report from the Centre for Research on Energy and Clean Air. The coal plants are expected to be built in Bangladesh, China, India, Indonesia, Japan, Madagascar, Pakistan, the Philippines, South Africa, South Korea, and Vietnam.

Timothy H. Wennes: Santander

Mr. Wennes is the CEO of Santander Bank, which continues to support the fossil fuel industry and its expansion. It does this despite claiming to support the Paris climate agreement and despite the urgency of the climate crisis. Santander consistently scores C to F grades concerning environmental practices, and continues to support one of Europe’s top polluters, Poland’s state-owned utility PGE, which has an ambitious five year, €8 billion investment program, with roughly two thirds of this being lined up to extend the lives of its existing hard coal and lignite plants and also to build new plants. In September 2018, Santander was part of a consortium that scandalously provided PGE with a €950 million loan.